ABOUT US

OUR WHY

Creating Hospitality That Inspires and Delivers

Our mission is to enrich the lives of our guests and investors by creating memorable, wellness-focused hospitality experiences that are both accessible and transformative. Each property is thoughtfully designed to foster well-being, connection, and a true sense of community—while delivering exceptional returns for our investors.

OUR EXPERTISE

From Acquisition to Operations, We Handle It All

Our expertise spans every aspect of property development and management:

Sourcing & Acquisition

Finding undervalued boutique hotels and short-term rentals with strong upside potential.

Design & Development

Collaborating with contractors and designers to transform each property into a high-performing asset.

Furnishing & Guest Experience

Creating spaces that inspire comfort, wellness, and repeat visits.

Operations & Management

Overseeing day-to-day management with precision, technology, and care.

OUR EXPERIENCE

A Proven Track Record in Hospitality Investments

With over $17 million personally acquired and managed in short-term rental properties and boutique hotels, and investments in more than 75 short-term rentals across the U.S. valued at over $37 million, our experience speaks for itself.

We have successfully navigated the highly competitive short-term rental market, consistently identifying high-potential opportunities that others often overlook. From sourcing undervalued properties to executing strategic repositioning, our team understands what it takes to create thriving hospitality investments.

OUR INVESTMENT STRATEGY

Focused, Disciplined, and Built for Strong Returns

At our Boutique Hotel Fund, our investment strategy is designed to unlock value in overlooked boutique hospitality assets. By targeting niche markets, sourcing undervalued opportunities, and applying hands-on operational improvements, we aim to deliver consistent returns while creating properties that guests love and investors trust.

Target Markets

Boutique hotels in leisure-driven destinations within a two-hour drive of major metros: Atlanta, Los Angeles, San Diego, and Tampa.

Deal Focus

Acquiring undervalued properties from mom-and-pop sellers, distressed owners, or mismanaged operations with clear repositioning potential.

Deal Size

Transactions between $2M–$10M — a unique space that’s too large for small investors yet too small for institutional players, giving us a competitive edge.

Risk & Return Profile

Moderate risk with a focus on outsized, experience-driven returns through proven value-add strategies.

Deal Sourcing

We uncover opportunities through off-market cold calls, broker networks, bank referrals, and selectively negotiated on-market deals.

Exit Plan

Refinance within 3 years to recoup capital and enhance returns.

Portfolio sale by year 5, with flexibility to sell properties individually for maximum value.

OUR FOUNDER

Meet Tim Ensmann

The Boutique Hotel Guy

Tim Ensmann is a boutique hotel investor, entrepreneur, and founder of the Boutique Hotel Fund, where he provides accredited investors with an alternative to Wall Street by investing in high-performing boutique hospitality assets.

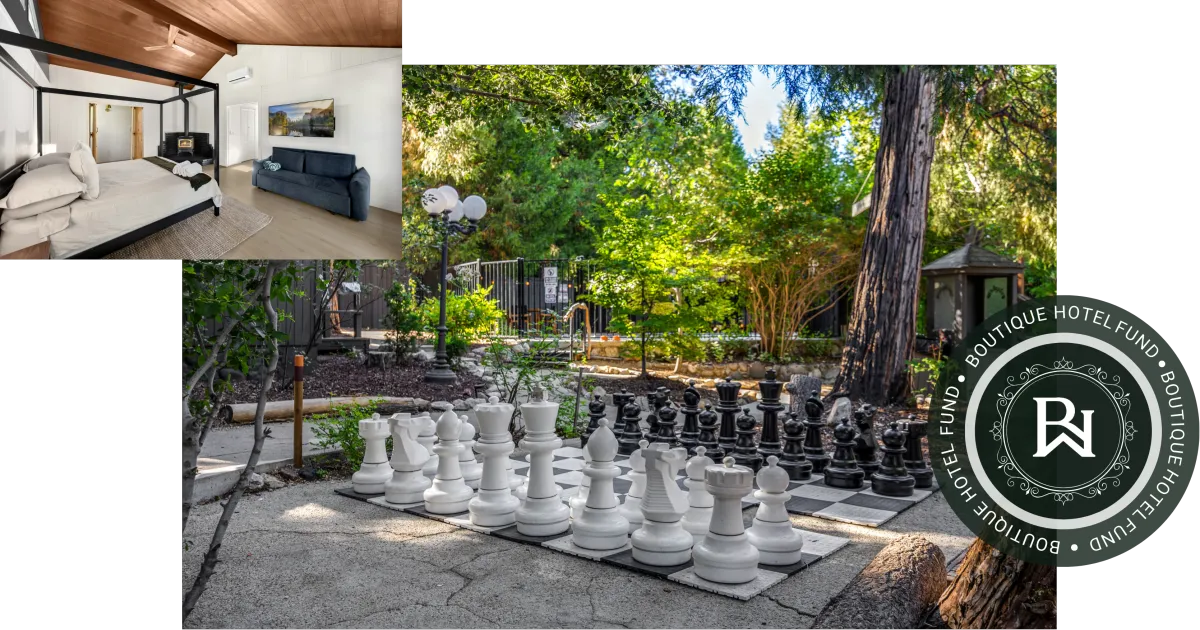

Since 2018, Tim has been building and operating short-term rental and boutique hotel projects across the U.S., with more than 20 value-add projects initiated and 10 successful exits. He is also the co-founder of Second Home Stays, a vacation rental management company, and the owner of The PineTree Hotel in Idyllwild, California — acquired for $1.5M in 2023 and now valued at over $4M.

With a background in scaling short-term rentals and repositioning hotels into lifestyle-driven experiences, Tim specializes in deal strategy, design, guest experience, marketing, and operational efficiency. His portfolio includes assets valued at over $11M, and his projects have consistently delivered strong returns.

Beyond investing, Tim is building a brand as the “Boutique Hotel Guy”, teaching others how to acquire, operate, and scale boutique hotels through educational content, courses, and speaking engagements.

His mission is to create memorable spaces that connect people to nature, community, and wellbeing while helping investors achieve real, lasting returns.

OUR CO-FOUNDER

Meet Isaac Silverman

Isaac Silverman is a co-founder of Second Home Stays and a real estate investor specializing in boutique hospitality and short-term rentals. Since beginning his real estate career in 2019, Isaac has completed 14 projects, overseeing everything from deal sourcing and contractor collaboration to design, furnishing, project management, and property operations. After a successful six-year career in sales leadership, Isaac transitioned to real estate full-time in 2022, focusing on scaling his own portfolio and building long-term cash flow through value-add opportunities and new construction-to-remodel style projects in the short-term rental space. As the driving force behind the brand, design, and operations of The Pinetree Hotel, he has played a key role in shaping unique hospitality experiences. To date, Isaac has invested in over $12 million in short-term rental properties and boutique hotels.

The Future of Boutique Hospitality Starts Here

Join our investor community and start building wealth through hotels that inspire connection and deliver exceptional returns.

“Transforming boutique hotels into thriving destinations that inspire connection and deliver exceptional returns.”

QUICK LINKS

CONTACT INFO

© 2025 Boutique Hotel Fund. All rights reserved.

“Transforming boutique hotels into thriving destinations that inspire connection and deliver exceptional returns.”

QUICK LINKS

CONTACT INFO

© 2025 Boutique Hotel Fund. All rights reserved.